CentSai prides itself on writing independent reviews. Check out our rubric to see the objective standards we use.

Highest Possible Total Score:

Myths about the stock market appear around every financial corner. The media often portray the market as an exclusive club for the 1 percent, and many believe that investing holds risks equivalent to those of slot machines and roulette.

Of course, as with any other subject, it’s crucial to educate yourself, seek advice, and fully understand what it means to be an investor before throwing your money into a new financial opportunity.

But with the influx of financial literacy resources across the web — as well as companies like Stash that have created hospitable platforms for beginner investors — there is a bright future for those of us who wish to build wealth and start making our fiscal dreams a reality.

Stash’s inviting tone and message helps newbie investors feel comfortable and safer in their future money endeavors. The company’s hands-off system allows you to put the decision-making process in the hands of Stash’s experts and algorithms. What’s more, you can buy fractional shares as your financial plan allows, starting at 1 cent.

Stash was founded in 2015 by Brandon Krieg, a former Wall Street trader who recognized a lack of knowledge about investing. And Krieg isn’t just talking about the average Joe — he witnessed experts like himself doubting where they should put their money. Krieg chose to grab this opportunity by the horns by creating a company that hones in on assisting new and existing investors.

Stash provides access to thousands of stocks, bonds, and exchange-traded funds (ETFs). This micro-investing platform is made for beginners who want to learn with a strong amount of guidance, but also have the option to explore the world of investing on their own terms.

There is no minimum balance for a portfolio, and you can start with a $5 investment to get a feel for the process.The monthly subscription fees ($1 to $9) cover the cost of managing your assets.

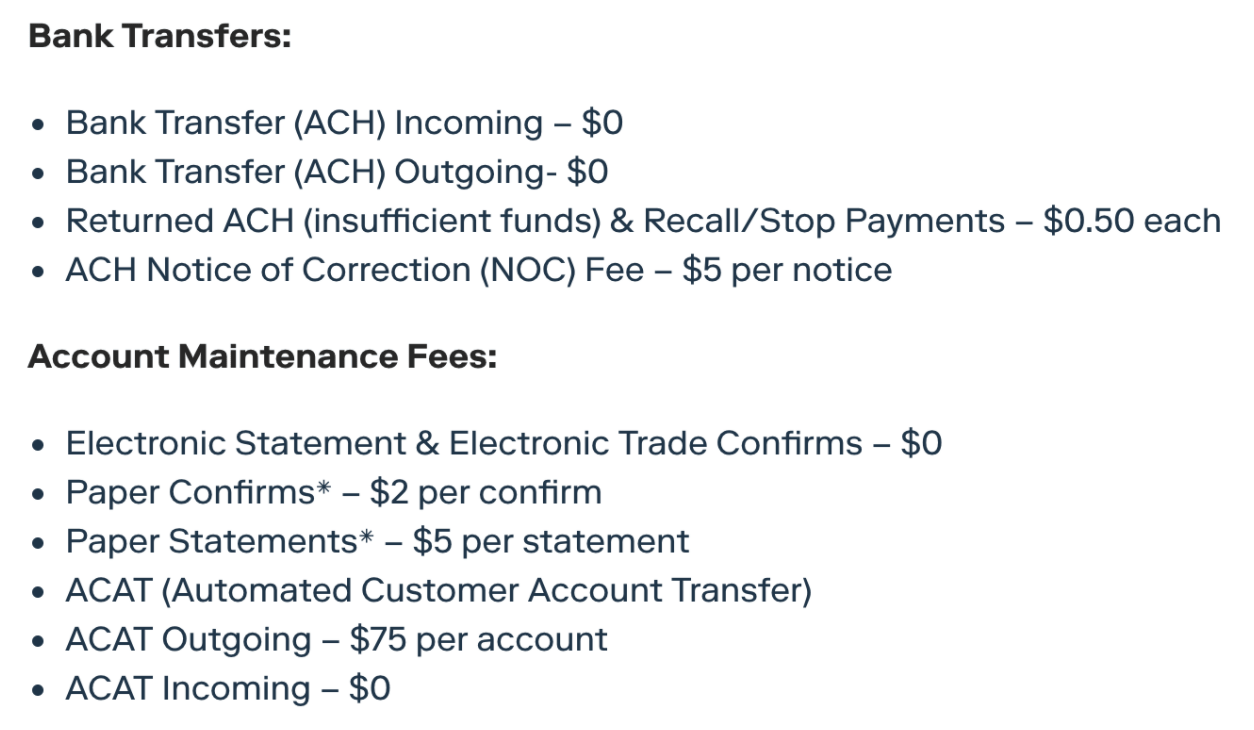

However, there are bank transfer and account maintenance fees when an account requires ancillary services out of Stash’s control. These fees are as follows:

Completing registration with Stash requires you to upload photos of both your driver’s license and Social Security card because, as the site informs you, it is required by law in order to open an investment account. Many of Stash’s competitors ask for your information only in numerical form, so it felt like an invasion of privacy to send photos of these documents.

These companies need to verify that you are the person you say you are, and if anything requiring this proof makes the company seem more reputable. However, to invest with Stash, you must also be a legal resident of the United States or a resident with certain valid visas.

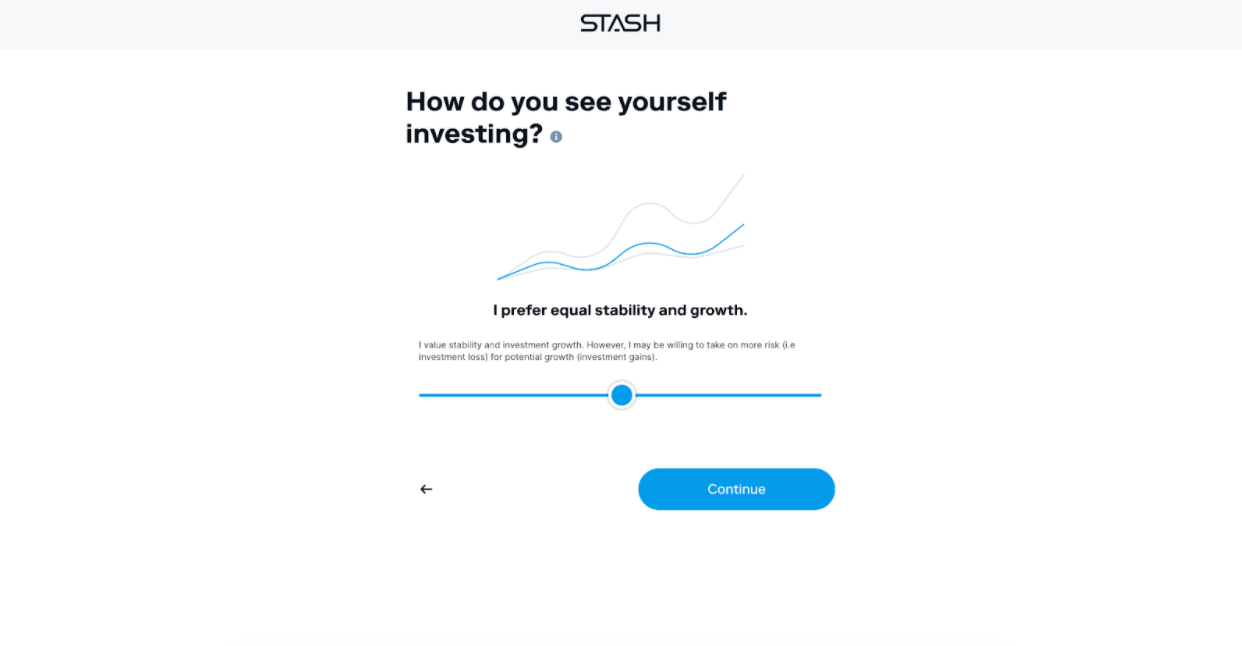

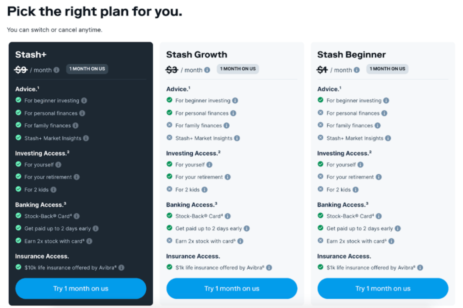

After completing the questionnaire, which evaluates your risk tolerance and investment goals, Stash asks you to select a subscription that best suits your needs.

Ease of Use Score:3

Ease of Use Score:3

Stash’s slogan — “Investing made easy” — says it all. The company’s goal is to make people more fluent in trading, buying, and selling — and I can corroborate it does exactly that.

Everything from the registration process to diving deep into investing in your future can be automated or as hands-on as you wish.

The tools offered are easy to comprehend and the app works as a financial Fairy Godmother for those just starting out.

Both the platform’s website and app have interfaces that are digestible and uncomplicated to navigate. There are “Learn More” tabs linked to all sections that, for some, may not be totally self-explanatory on their own.

Stash aims to simplify the process of investing for a range of beginner investors, and in my opinion, the company has accomplished that goal. Read on to learn more about Stash’s noteworthy features.

Bang for Your Buck Score:4

Bang for Your Buck Score:4

Working in unison with the company’s approachability, Stash’s subscriptions prices are nominal, ranging from $1 to $9 per month. The company offers three different plans to choose from depending on your wants and needs. Here’s a quick breakdown of your options:

Stash Beginner:

- $1 per month

- Includes investing, Stock-Back Card (see below for explanation)

- Banking

- Saving tools

- Personalized recommendations and advice

Stash Growth:

- $3 per month

- Everything from Stash Beginner

- Smart Portfolio: made by experts and uses targeted ETFs tailored to your Stash risk portfolio

- Retirement account (Roth or Traditional Individual Retirement Account)

- Tax benefits for retirement investing

- Personalized retirement advice

Stash+:

- $9 per month

- Everything from Stash Growth

- Children’s custodial accounts

- Exclusive Stock-Back Card bonuses

- 2x stock with the Stock-Back Card

- Premium research and advice

- Optional $10K life insurance offered by Avibra

Rather than offering cashback rewards, the company allows you to earn stock rewards when you shop with a Stash debit card, known as a Stock-Back Card.

Stash supplies a fractional share of stock when you make a purchase with the Stash debit card from any company with public stock. If you shop at a small, private retailer, you are rewarded with a diversified fund. Stash will automatically deposit the amount of your reward into your Stash account by initiating a “buy” order for the stock.

This differs from common rewards programs because these rewards have no expiration date, and have the potential to appreciate overtime. That being said, the opposite is also true: Your Stock-Back Rewards can lose value as well.

After catching sight of the subscription options, you can see the price is right at Stash. But what are you really getting out of these plans? One of the main reasons I’m giving Stash a 3 out of 3 for this category is because of the personal investment options.

Once Stash Growth and Stash+ users have answered a variety of questions regarding basic personal and financial information, its Smart Portfolio creates an automatically balanced portfolio that suits the needs of each individual customer.

This tool helps diversify your investment plan, and most importantly for me, puts a lot of the decision-making weight in the hands of Stash’s experts and algorithm. The site has it down to a science.

Another option is the Personal Portfolio, which allows you to browse all stocks and ETFs and invest as you see fit.

But even within the more hands-on Personal Portfolio option, Stash offers recommendations on how to diversify your portfolio using handpicked investments that reduce risk and offer an analysis breakdown. At every level, there is calculated assistance along the way, and for just a few dollars a month, you’re getting your money’s worth.

Another reason for my rating is the additional resources that Stash includes in all of its subscriptions. StashLearn brings you quality articles and in-depth quizzes on a range of financial education topics.

With titles like “What’s a Reverse Stock Split?,” “Graduate School: Should You Go?,” and “How to Plant Roots in the Green Economy on Earth Day,” StashLearn has a wide scope of articles and quizzes to expand your knowledge.

Customer Service Score:2.5

Customer Service Score:2.5

Stash knows its young target audience very well. The proof is in the details, all the way down to the songs played while you wait on hold for a customer service representative.

I had a few minor questions about Stash’s investing algorithm and cancellation policy, so I made the call. While I was on hold, I bobbed my head to some funky, modern tracks.

After nine minutes of pop songs, I was greeted by a customer service representative who, to my surprise, immediately knew the answers to my questions. They were extremely thorough and courteous. The experience made me feel confident in their understanding that any of my problems as a Stash customer are their problems to solve.

Unfortunately, I docked them half a point for the wait. I believe a company with a valuation at $1.4 billion, during a time of automation and instant gratification, should be a little bit quicker to answer the phone — especially when a user’s money is likely the focus of conversation.

Reputation

Reputation

On Google Play, the company has received about 62,000 reviews, which round out to a 4.1/5. The App Store’s reviews put Stash on a pedestal, with 234,000 ratings, and 4.7/5 stars, and a ranking of #38 on the Finance charts.

However, I was appalled by the stark contrast between these ratings and those that live on Stash’s Better Business Bureau page. Stash has received 100 customer reviews that average out to 1.63 out of 5 stars, and was rated F by the company. To make matters worse, from the looks of it, Stash has not responded to or resolved a single one of these complaints.

These reviews are outliers but they cannot be ignored. I reached out to Stash’s press office for acknowledgement and commentary on this predicament. The response from Sarah Spagnolo of Stash’s press team is as follows:

“Our customers are at the heart of our company: As a fiduciary, we act as a trusted advisor to our clients. We respond and work to resolve comments made with the Better Business Bureau, and always design our personalized suite of products with customers in mind. We cannot respond publicly to protect the privacy of our clients and to avoid violating various other laws, rules, and regulations.”

Stash is proud to share that it is trusted by 5 million customers worldwide. Although the BBB page is startling, it’s pertinent to remember that these 100 are competing with hundreds of thousands of positive reviews. In the grand scheme of things, Stash is reputable, keeps its promises, and has stuck to its core beliefs and goals over the last five years.

The Bottom Line

For most of my life, I have been taught to believe that investing is something for uber-wealthy folks. Just the concepts alone have always intimidated me, so up until recently, I avoided it all together.

But as someone who has had the privilege of being exposed to the finance industry, and after learning about companies like Stash that are working to change this societal thinking, I feel enlightened and am increasingly more interested in what the investment world has to offer.

I appreciate Stash’s commitment to its foundational values, and have experienced the authenticity through its product firsthand.

If things like the stock market, wealth building, and risk-averse investing spark curiosity for you, I recommend exploring what Stash has to offer. If you have a bit of a background in this subject and want to make guided investment decisions with a reputable company, you also should look no further than Stash.

Past performance is not a predictor of future results. Individual investment results may vary. All investing involves risk of loss.