Looking for ways to save money on forgotten subscriptions or service interruptions? You may want to check out Truebill. Founded in 2015, it’s a free personal finance app created by Truebill Inc. You can download it from the Apple App Store and the Google Play Store.

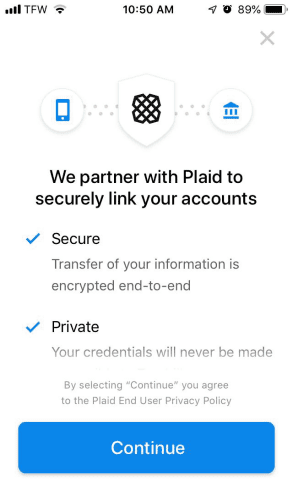

Users can create an account quickly, and once you do, Truebill asks you to link your bank account. It provides the option to add your credit cards, as well. You can decide how much information you want to provide, but the most accurate way for Truebill to track your spending is to be able to see all of your accounts and cards. This way, it can look for redundant subscriptions or higher-than-normal bills.

Some people may be worried about providing their financial information on a website or app. However, Truebill uses 256-bit encryption to help keep its customers’ information safe.

Some people may be worried about providing their financial information on a website or app. However, Truebill uses 256-bit encryption to help keep its customers’ information safe.

Since it has read-only access, Truebill can’t make any changes to your account. However, the information allows the app to track your spending and monitor your subscriptions. What busy person doesn’t need help with that?

Truebill provides multiple ways to save money — potentially hundreds of dollars a year.

Truebill Summary

- Finds and cancels unused or forgotten subscriptions

- Helps negotiate bills to save you money

- Monitors cable, internet, and utility outages in your area so you don’t have to pay for outages

Finds and Cancels Unused or Forgotten Subscriptions

Once your bank accounts and credit cards are linked, Truebill scans for recurring charges and asks your permission to cancel any unused or forgotten subscriptions it encounters. You can then decide which services or subscriptions to nix.

If you upgrade to the premium version (price details below), Truebill will provide automated cancellations for you, as well as a host of other services. This saves you the hassle of canceling your unused subscriptions one by one yourself.

Helps Negotiate Bills to Save You Money

Another way Truebill helps save money is by potentially lowering bills. Once you connect your bills to your account, negotiators begin looking for hidden discounts and promo rates for you. Truebill can negotiate better rates or find one-time credits that can be applied to your bill. Companies Truebill negotiates with include: Comcast, Cox Communications, Verizon Wireless, Time Warner, Sirius XM, Sprint, AT&T, Charter, Cox, Verizon Fios, and others.

You then receive an email from Truebill to let you know how much money you’ll save. Whether you use the free or the premium version, Truebill charges you 40 percent of what you save. Be mindful that they charge you 40 percent of the entire year of the savings.

So for example, if you have a subscription that costs $100 per month and Truebill gets the rate reduced to $80 per month, you’ll owe Truebill 40 percent of $240 ($20 per month for 12 months), which is an upfront payment of $96. If the company is unable to negotiate any savings, you don’t pay anything for their negotiation attempt. You also have a say in which bills they negotiate for you.

Monitors Cable, Internet, and Utility Outages in Your Area

Truebill also monitors for outages. If your electricity goes out or your cable or internet is down, the company will request a credit to your account. This means you only pay for what you actually use; no more paying for downtime — which let’s face it, is cool. The fee for this is 40 percent of the amount credited to you for the outage.

We’ve all experienced times when our internet stops working. Why should we pay for those four hours of wasted service?

Last, Truebill helps save money through the electric saver feature. The feature is available only in areas where electricity is deregulated. In these areas, Truebill will help find the provider with the lowest rates to help you save money on your electric bill.

Bang for Your Buck Score:2.5

Bang for Your Buck Score:2.5

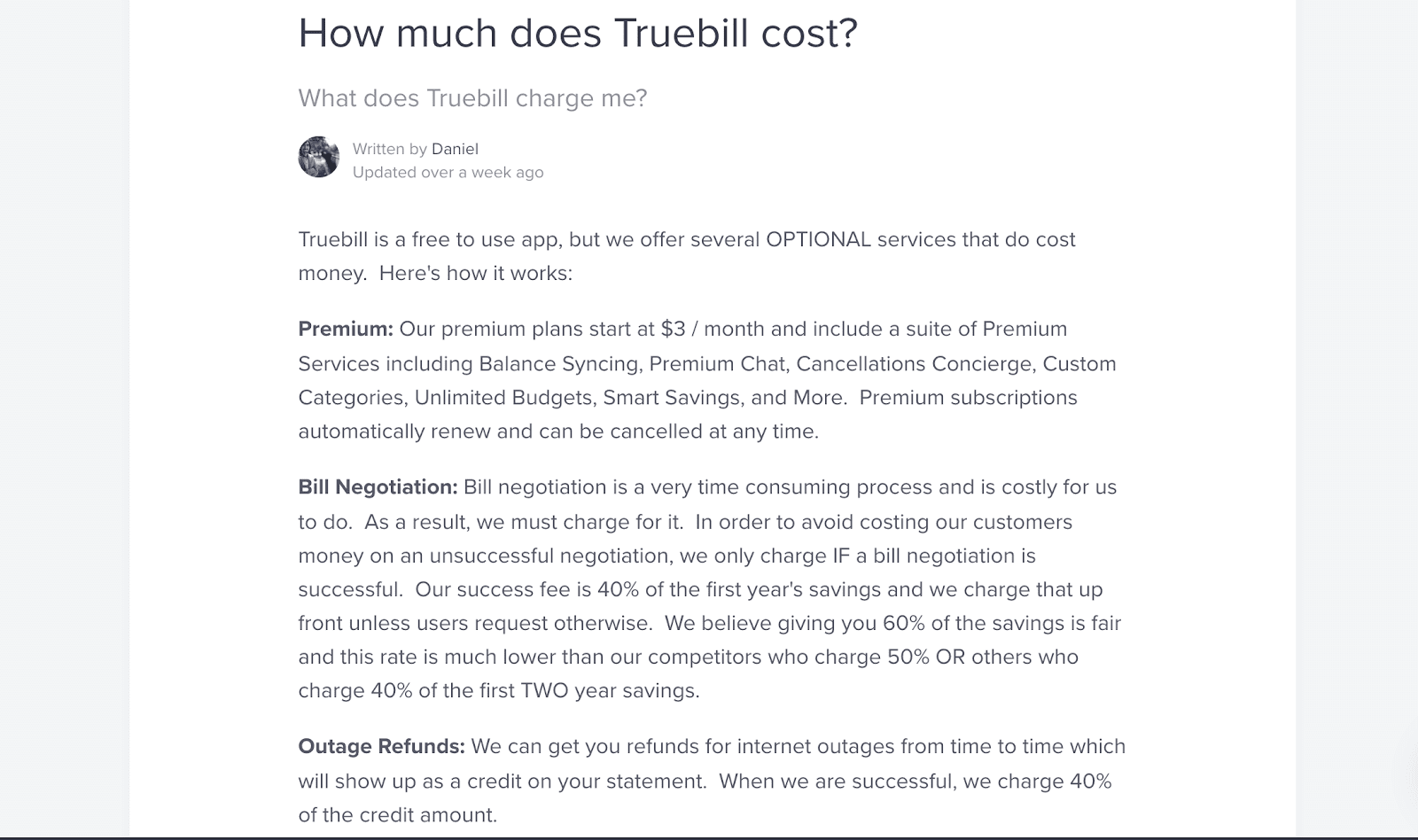

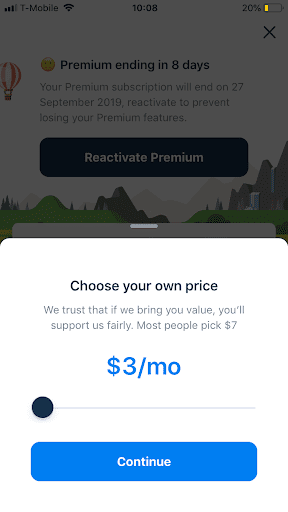

If you use the free version, you pay Truebill only the 40 percent they collect when they reduce your bill totals. However, you can upgrade to the premium version. There seems to be a bit of confusion about what premium costs, as different sources provided different answers.

On the site, Truebill says:

How the Subscription Works

The subscription starts at $3 a month, but Truebill encourages you to pay more if you think the company has done right by you. It lets you know most people choose to pay $7 month for premium (hint, hint!), and the sliding scale ends at $12. It’s a cool idea, but it took us a while to get to the bottom of the premium pricing model.

Upgrading to Premium

With this upgrade to premium, you receive automated subscription cancellations, unlimited budgets and categories, smart savings, overdraft and late- fee refunds, and premium chat support, plus you can sync all of your accounts. Overdraft fees at your bank can cost you more than $30 each time you are charged, so the price for a year’s subscription is not much more than just one overdraft fee.

With the premium version, you still pay 40 percent of what Truebill saves you on your bills. If you consider the refunded overdraft fees and late fees included in the premium version, you could potentially save much more than you would spend on a one-year subscription. Not to mention, you save money by not paying for subscriptions you’re no longer using. It’s easy to see how someone might save more than $100 when first using the service.

If you choose to upgrade to the premium version, your subscription automatically renews unless you turn off the auto-renew feature at least 24 hours before the current period ends. If you are trying out the premium version and later decide you no longer need it, make sure to cancel before the end of the current period.

The Differences Between Pricing Models

We spoke with a representative to get a general picture of the different options.

“The app is offered on a sliding scale from $3 to $12, but if you purchase through the Apple Store or Google Play Store it is $4.99 per month. An annual subscription is $35.99 per year (which is actually much cheaper than even doing the $3 per month option),” he explains.

“We take a 40 percent success fee of what you save over the next 12 months. For example, if we save you $100, we’ll charge you $40. This can be paid upfront or you can request a payment plan. In the event that your savings are good for multiple years, we will only charge that 40 percent of the first year’s portion.”

Customer Service Score:1

Customer Service Score:1

There is no customer-service phone number in the app or on the website that I could find in my search. There is a help or FAQ section on both the site and the app where you can either search for answers to your questions or you can send a message. Truebill says messages will be answered within 24 hours. I sent one message to customer support and received a reply within minutes. In another instance, I waited more than an hour.

On the website, there is a form you can fill out to be contacted. If you decide to upgrade to the premium version, you have access to premium chat, where you get priority support and access to live chat with a customer advocate from 8:00 a.m. to 8:00 p.m. EST Monday through Saturday.

Ease of Use Score:3

Ease of Use Score:3

Truebill advertises that it helps you track your budget, your expenses, and save money.

The process itself is simple. Download the app, enter your basic personal information and financial details, and you’re off to the races!

You can then create a monthly budget and track your bills and subscriptions from your phone. In the app, you can also choose which subscriptions to cancel and which bills you want to negotiate. Plus, you can enable TouchID for extra security.

Reputation Score:2

Reputation Score:2

Truebill has a 4.6-star rating out of 8,963 total reviews in the Apple App Store and a 4.4-star rating out of 2,496 total reviews in the Google Play Store. Both include reviews from customers explaining that Truebill helped them save money.

Truebill’s Ratings and Reviews on the Better Business Bureau

Truebill is not accredited with the Better Business Bureau (BBB), a private nonprofit intended to help consumers find trustworthy businesses. It’s worth noting, though, that businesses must pay for accreditation, as Truebill co-founder and CEO Haroon . In fact, the majority of the 5.4 million businesses on the BBB site don’t pay for accreditation, according to Hank Parry, a spokesperson for the Better Business Bureau of Northern Nevada and Utah.

That said, accreditation has little to no effect on a company’s BBB rating, and unfortunately, Truebill received an F from the site. The BBB lists three reasons for the rating: an unresolved negative review, the existence of 20 complaints against the company, and the “length of time the company has been operating.”

The number of complaints is weighed in a company’s score in relation to “the size of the business,” Parry says. The majority of the BBB complaints are about bill negotiations not meeting customer expectations. Truebill did respond to most reviews. Of those, a majority have been updated by the customer to show the issue has been satisfactorily resolved.

Truebill Reviews on Facebook

A quick look-over of Truebill’s Facebook page shows a few positive reviews, but also some negative ones. The main customer complaints include being overcharged for services, bills only being lowered because they were downgraded to a basic plan with their service provider, and not being able to get a response from customer service.

Truebill Review: Final Thoughts

Truebill is helpful for tracking your monthly spending and subscriptions, especially if you’re using the free version of the app, in which you pay nothing initially while Truebill looks for ways to save you money.

The service allows you to monitor all of your spending within one app instead of switching between your banking apps if you have multiple bank accounts or credit cards. You’ll have one place to monitor all your spending.

There is no requirement to upgrade to the premium version unless you want access to the premium features. Customer service is available only through email, so you’ll have to wait for an email response, which can take up to 24 hours.

You can also choose which bills you want Truebill to negotiate for you. That way, the service doesn’t just start negotiating on your behalf without your permission or knowledge. Truebill is aimed toward people who are looking for ways to save money, and all considered, the app does what it is designed for. Some people even say they saved hundreds of dollars in a year. That seems smart to us.

R

Additional reporting by Evan Sachs.