Yes, going through the terms and conditions of your health insurance policy is enough to pose enough questions to drive anyone into a stressed-induced chocolate binge. But if you look at each term as a part of a whole — the concepts begin to fall into place.

Even for our leaders, healthcare is a hot potato no one wants to hold, so they pass it on for someone else to handle. As a result, not much progress is made regarding health insurance.

When COVID hit, health insurance became a central focus, with so many becoming ill. As a result, Americans have lost — on average — one year of life expectancy as a result of the pandemic. That’s no joke.

How Does the United States Compare With Other Countries Regarding Life Expectancy?

According to the World Bank, the United States does well compared to the world regarding life expectancy, for both males and females.

World Bank: Life expectancy at birth, female

World Bank: Life expectancy at birth, male

The astute reader will notice females have a longer life expectancy than males. We’ll be talking more about that next week when we start on life insurance. If we look at High Income countries and others with a high life expectancy, the picture changes. Other countries are doing great, and we are doing well. There is room for improvement.

| Country Name | 2018 |

| Australia | 82.74 |

| Bermuda | 81.65 |

| Barbados | 79.08 |

| Canada | 81.94 |

| Chile | 80.04 |

| Costa Rica | 80.09 |

| Cuba | 78.72 |

| European Union | 81.039 |

| United Kingdom | 81.25 |

| High income | 80.65 |

| Hong Kong SAR, China | 84.93 |

| Israel | 82.80 |

| Japan | 84.21 |

| South Korea | 82.62 |

| Macao SAR, China | 84.11 |

| New Zealand | 81.85 |

| Qatar | 80.1 |

| Singapore | 83.14 |

| United States | 78.53 |

World Bank: Life expectancy at birth, total, selected countries

How Much Do Countries Spend on Health Coverage?

According to the World Health Organization, health spending in most countries is growing faster than GDP, regardless of income group.

All members of the United Nations have agreed to achieve universal health coverage by 2030, as part of the Sustainable Development Goals.

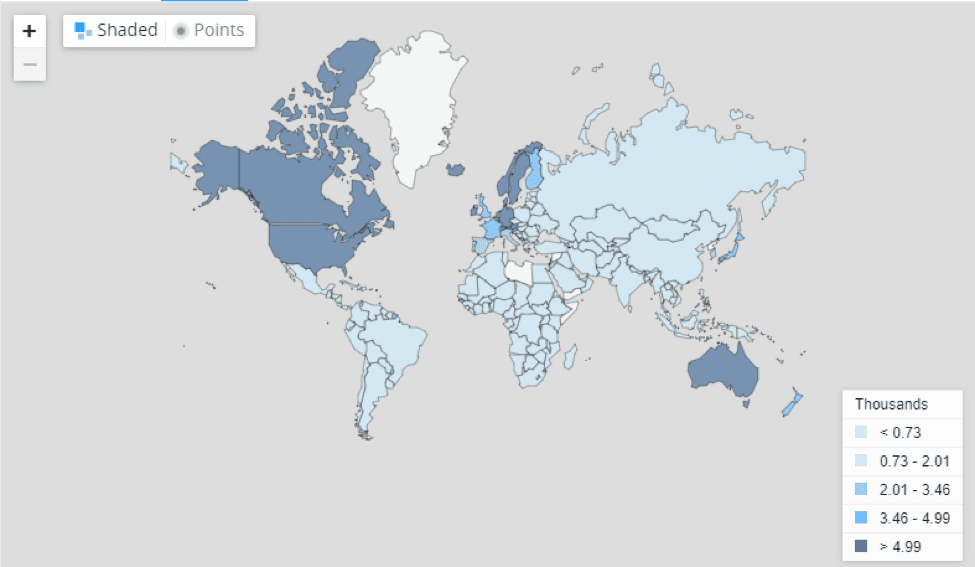

World Bank: Current health expenditure by per capita (in current U.S. $)

Looking at health expenditure per capita, the United States, Canada, Australia, and some European countries are leading the world. On the surface level, it seems we are spending more as a country, but not getting the same life expectancy results. This doesn’t take into consideration quality of care or time waiting, but it’s something to think about.

So how can we improve health outcomes, expand health coverage, increase life expectancy, while reducing costs?

It’s a tough question to ask and tackle.

Let’s continue with our healthcare.gov policy and analysis.

What Is the Difference Between In-Network and Out-of-Network?

In this example, in-network coinsurance is 50 percent coinsurance after paying your deductible. In other words, after you pay your deductible of $8,000, you will pay 50 percent of an office visit.

Out-of-network (doctors and hospitals the insurance company doesn’t cover) expenses are not covered in this policy. You would be on the hook for covering the full out-of-network costs. That’s why it’s always a good idea to be familiar with who your plan considers in and out of the network.

In-network coinsurance is the percent (for example, 20 percent) you pay of the allowed amount for covered health-care services to providers who contract with your health insurance or plan. In-network coinsurance usually costs you less than out-of-network coinsurance.

Out-of-network coinsurance is the percentage (for example, 40 percent) you pay of the allowed amount for covered health care services to providers who don’t contract with your health insurance or plan. Out-of-network coinsurance usually costs you more than in-network coinsurance.

If your plan doesn’t cover out-of-network providers, you have to pay for everything, which means your coinsurance is 100 percent. There are plans that do cover out-of-network providers, and that’s when your coinsurance will matter.

Why Do Pre-Existing Conditions Matter?

A pre-existing condition is a health problem, such as asthma, diabetes, or cancer, with which you were diagnosed prior to when the date your new health coverage starts. Insurance companies can’t refuse to cover treatment for your pre-existing condition or charge you more.

Pre-existing conditions matter, greatly. Suppose someone you know gets cancer. They beat it and the cancer goes into remission. Suddenly, it comes back after a decade. It would be considered a pre-existing condition, and coverage could be greatly reduced when they most need it.

Under the current law, health-care companies can’t charge you more or deny coverage due to a pre-existing condition.

My own example, I have a small, congenital hole in my heart. If I didn’t have pre-existing coverage, my family would be on the hook if I had a stroke as a result of the hole. It’s serious. Eliminating coverage for pre-existing conditions would be good for insurance companies, but not good for patients.

Why is Mental Health Coverage So Crappy?

Example of mental health and behavioral health coverage costs with coinsurance.

Mental health coverage being crappy is unfortunate. My guess: Accountants did a cost/benefit analysis, and they saw that mental health coverage is expensive and would raise premiums greatly. Best to make a token effort.

Before the pandemic, almost one in five Americans lived with a mental illness. I don’t know about your mental health, but this last year has not been kind to my mental health. Hopefully, this improves the mental health services covered by insurance companies.

How Do I Know if I Need To Get a Procedure Pre-Authorized?

The best way to find out if a procedure needs to be preauthorized is to call your insurance company. Hospitals have also become more efficient working with insurance companies. If your procedure or surgery can be scheduled in advance, it’s best to preauthorize. If it is an emergency, call your insurance company as soon as you can.

Does My Health Insurance Cover Drugs, Dental, and Vision?

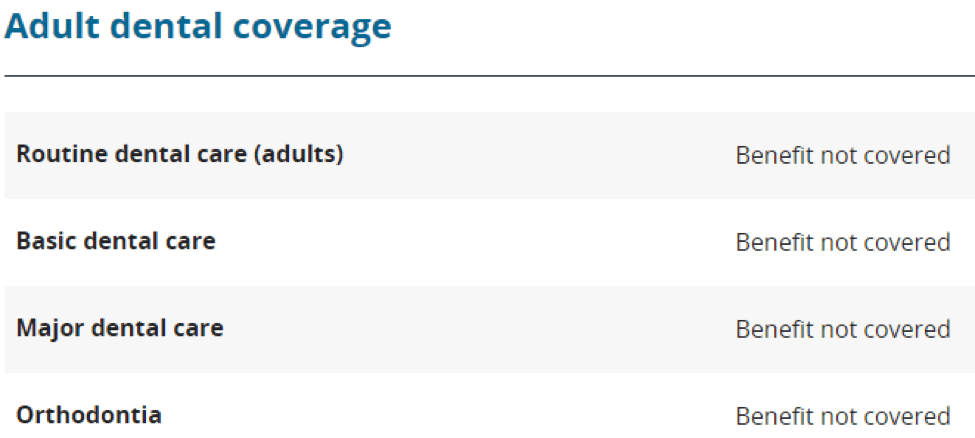

In our sample policy, adult dental coverage is not covered.

In the same policy, eye exams for adults are not covered, but they are covered for children.

Most health insurance covers some drug costs, though they may not be the brand your doctor prescribed. Vision and dental aren’t usually part of a combined offering with major medical insurance. There are some plans available, at a higher cost.

How Is Disability Insurance Different From Health Insurance?

Disability insurance covers you if you are not able to work, and is a separate policy from your health insurance.

An example: If you are unable to work for one month, short-term disability insurance may cover you for 50 percent of your income on a bimonthly basis. After four weeks, you may switch to long-term disability insurance—if you have it—which may cover you at 67 percent of your income.

Health insurance covers you for annual primary care checkups and if you get sick or hurt.

Said another way, disability insurance protects your income, and health insurance helps reduce your expenses, particularly at higher levels.

What is the Affordable Care Act?

The Affordable Care Act is the comprehensive health-care reform law enacted in March 2010; it’s also known as ACA, PPACA, and “Obamacare”.

The law has three primary goals:

- Make affordable health insurance available to more people. The law provides consumers with subsidies (premium tax credits) that lower costs for households with incomes between 100 percent and 400 percent of the federal poverty level.

- Expand the Medicaid program to cover all adults with income below 138 percent of the federal poverty level. (Not all states have expanded their Medicaid programs.)

- Support innovative medical-care delivery methods designed to lower the costs of healthcare.

How Does the American Rescue Plan Act Reduce Health Coverage Costs?

Recently, the American Rescue Plan Act was passed by Congress, and signed by President Biden. The American Rescue Plan does a few things to reduce health coverage costs and expand coverage.

- Anyone who pays more than 8.5 percent of their income for individual or family coverage qualifies for Affordable Care Act subsidies, regardless of income.

- The Act introduces COBRA.

- The Act improves Medicare.

- The Act waives repayment penalties for people who received more subsidies than they should have, because they underestimated their income.

These changes are temporary for 2021 and 2022.

How Do I Reduce My or My Family’s Health Costs?

There are options if you can’t afford health insurance. Health coops exist, ACA policies exist, group health insurance with other small business owners may be a possibility. Travel healthcare exists. Medical tourism definitely exists. People don’t know about these options.

I had a family friend of my parents who needed a quadruple bypass many years ago. I think the cost was $150,000 whereas going to India or Thailand would have cost only $25,000.

Since this is a major purchase, look around at different health insurance companies, contact health insurance agents, and educate yourself on how much you can pay and afford to pay.

The best way to stay healthy is to exercise, eat less salt, follow a Mediterranean diet to keep your heart healthy, keep your immune system strong, meditate to reduce stress, and spend more time outside.

We at CentSai hope that Part 2 of this frequently asked questions guide helped you break down health insurance into digestible chunks.