You know you have to save money. But it can be daunting, especially if you’re struggling with debt. There are quick ways to save money, despite being cash-strapped. Whatever amount you stash away, it’ll be a huge help in the long run.

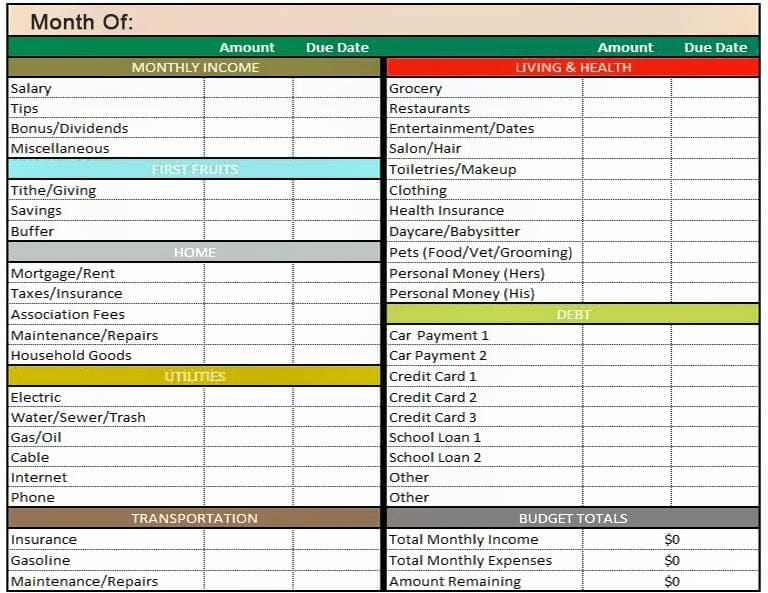

To help you get started, you first need a budget.

What Should a Budget Look Like?

When creating a budget, you’ll have to start with a proper self-assessment of your financial condition, cut corners on expenses, and lead a frugal life.

Add Technology to Your Financial Planning

If you’re in debt due to undisciplined spending, then you can add technology to your money-saving strategy to help you save money better and more quickly. Apps can help you automate your budget, savings plan, and spending habits. Some of the more prominent ones are Mint, You Need a Budget (YNAB), BillTracker, Ibotta, GoodRx, and so on.

Get Help With Budgeting Today — Download the Personal Finance App Here >>

Quick Ways to Save Money

Once you’ve laid the groundwork to save more money, here are some quick ways to put your plans into action:

1. Shop at the Cheapest Grocery Stores

1. Shop at the Cheapest Grocery Stores

Groceries aren’t cheap. And retail food prices are skyrocketing. Another easy way to save money quickly is by cutting down on the amount you spend on your weekly shop. Some stores may save you more on groceries than your nearest Walmart. Here are some of the places with the most affordable deals:

- WinCo

- Aldi

- Sprouts and Fresh Thyme

- Salvage grocery outlets

- Trader Joe’s

- Fairway

2. Reduce Your Bills

You can increase your savings by cutting down your various outstanding monthly bills. Cut out items that take up a large share of your paycheck. These could include cable TV, Netflix, gym membership, phone service, and so on. Ask yourself, “Do I need these services at all?” If you answer no, then stop wasting your money on them.

Next, identify ways to reduce the charges of services that you need to keep and pay for. For instance, if you use credit cards, you can contact your card issuer to check out whether or not the company would be willing to slash the rate on your balances.

Save on Your Bills and Manage Unwanted Subscriptions — Sign Up Here >>

3. Increase Your Insurance Deductibles

This is another smart way to create an additional space in your budget and catapult your savings. Many people buy insurance, and it’s your choice whether or not you’d like to keep it. But if you’re paying for insurance, why not raise the deductible? Doing this will dramatically reduce your insurance premium.

For instance, the Insurance Information Institute says that if you raise your car insurance deductible, you can reduce your premium by 15 to 40 percent, depending on how much you raise the deductible by.

And apart from that, you can invest your money in a high-deductible health insurance plan to enjoy more affordable premium. To offset the higher deductible, you might want to contribute a certain amount of your payroll deductions (a pre-tax money) towards a health savings account (HSA) and use it to pay for your out-of-pocket costs.

4. Wipe Out Your Debts

Never ignore the telltale signs. A small debt can quickly balloon into a large, overwhelming amount through over-limit charges, late fines, and high interest rates. Paying off debt should be your top priority when setting your budget.

Consolidating your debt can help you pay it off easily, provided that you have a steady source of income. But make sure that you always make the monthly payments on time.

Get a Free Debt Relief Consultation — Visit Site >>

You can also use one of two debt repayment strategies:

The ‘Debt Avalanche’ Method

You’ll have to pay back the highest-interest-rate debts first. This method will help you save hundreds — maybe even thousands — of dollars in the long run.

The ‘Debt Snowball’ Method

Using this method, you repay the smallest debt first. It will be easier to take care of that small amount. Plus, this will encourage you to continue making repayments.

You can choose any debt repayment method you want, but make sure to create a realistic plan to achieve your goals.

Allot separate funds for each category — groceries, monthly payments, medicines, leisure, etc. — to keep yourself from burning out.

5. Keep More From Your Paycheck

If you’re living from paycheck to paycheck, a tax refund can seem like a windfall. But your tax refund is basically an interest-free loan to the government. You’re allowing the Internal Revenue Service to withhold a large portion of your paycheck for way too long. Ask your employer for a fresh W-4 form to claim more allowances. This will reduce your taxes while increasing your savings.

Get the Most out of Your Refund — File a Free Federal Tax Return >>

6. Curb Your Impulses

The most important way to save money? If you're serious about saving money, change your impulsive “need it now” attitude. Choose financially rewarding ways to unwind or to feel better instead of trying to live someone else’s life. Put in extra effort to curbing your lifestyle inflation when you get a bonus or raise; adopt some frugal habits; and avoid trying to keep up with the Joneses.