Who we are and where we end up in life is a product of the many decisions that we make, both large and small. Who knows whether I ended up where I am because of the handful of major life decisions I made or because missing the bus one morning led me down a different path? But regardless of the power that little decisions have to shape a person’s life, it’s indisputable that the big decisions have a significant, long-term impact — even the mistakes.

I’ve already taken several wrong turns and have to live with the consequences, for better or worse. Hopefully others can learn from my poor life decisions — or at least make their own with eyes wide open. I don’t have it all to do over again. But if I were reborn today, here are the mistakes in life that I would not repeat:

- Going to college and not into a trade

- Taking out student loans

- Giving up a job and moving across the country for love

- Having a joint checking account with a significant other

- Jumping into marriage

Going to College and Not Into a Trade

Choosing whether or not to go to college is one of the biggest forks in the road that most of us will face. I would just say no to college and opt to learn a skilled trade.

Achieve Your Career Goals With Industry-Recognized Learning Paths — Choose Your Course >>

I was a good student but had no interest in attending college. Completely unlike my math-, science-, and sports-oriented older siblings, I was an artsy, creative type who wanted to become a fashion designer, hairdresser, or chef. But my mother told me that working with my hands was lower class.

According to her, people would always treat me poorly — like a servant. I remember my brother pulling me aside and lecturing me about how I needed to go to college, even if the school was one of the hippie-dippie colleges my parents weren’t thrilled about.

Because I turned 17 right after finishing high school, going away to college was the only way to move out of my parents’ house and have any freedom before I was 18. Let me tell you, that one early year of freedom was not worth the financial prison I now live in.

College does serve a great purpose insofar as it provides a semiprotected space for young adults to experiment with sex, drugs, and different life philosophies. In fact, that pretty much sums up my undergraduate experience. Unfortunately, it is no longer a direct path to a well-paying, stable career.

A bachelor’s degree does not get you far in today’s world, and I wouldn’t invest four years of my life and tuition money for one.

If the career you know you want requires a college education, by all means go for it. Hopefully it’s in a STEM field, and you do a second major that’s your fun passion project. But if you feel the slightest hesitation, take at least a year off and explore your options.

If you want long-term job stability, go into something that cannot be outsourced overseas. A factory worker in China or someone in a call center in India can't fix your air-conditioner when it’s 95 degrees in Miami in July.

Jobs in which you make or repair something essential have longevity. Even if robots have replaced many assembly-line workers, we’re still a long way from having one come to your home to fix that AC unit.

According to the Bureau of Labor Statistics, installation, maintenance, and repair occupations are expected to grow seven percent from 2016 to 2026 and have a median yearly salary of $43,440, which is about $6,500 higher than the median for all occupations. Growth of nine percent is predicted for legal occupations, whose median annual income was $79,650 in 2016.

At first glance, legal occupations look pretty good when compared with installation and repair careers. Am I just bitter and blind to how good I have it? Nope — it’s a little more complicated because we’re comparing apples and oranges. There are only one-third as many jobs in the legal field.

As law firms continue trying to reduce costs, they will focus on hiring less expensive paralegals instead of lawyers, but still those paralegals almost always have to have a four-year college degree.

Becoming a lawyer means at least seven years of higher education — seven years of deferring income and paying tuition before being able to get that first job, which is highly unlikely to pay the median amount.

Plus, the median is not the best representation of pay in the legal field because the salaries are not clumped closely around the median. There are those of us making $40,000 annually, and then there are the partners at mega-firms making $10 million. If you want the latter gig, you better plan on going to a top-10 law school and graduating in the upper 10 percent of your class.

I’m not where I am because I’m an idiot or an incompetent. I went to a decent law school, graduated magna cum laude, and passed the bar on the first try in Florida, Massachusetts, and New York. But law is a field where one is swimming upstream. Even the best and brightest of us can’t always succeed at it.

Plus, I made some very poor life decisions, which you’ll hear more about below.

A significant portion of the sort of legal work I do now is outsourced to India or being done through artificial intelligence. I make less per hour as a lawyer — often $23 to $25 — than if I worked on a factory assembly line. I have no benefits whatsoever and don’t know from one day to the next whether I’ll have work.

The attorneys making millions — or even a “mere” six figures a year — are a tiny group at the top of the pyramid, and they’re working 80-plus hours a week to be there. The rest of us are like ants to our clients — we don’t matter, we don’t make a difference, and we are totally fungible.

Check out the Bureau of Labor Statistics website to see the fastest growing and highest paying occupations, as well as the ones that are creating the most new jobs. Just remember that you cannot compare those professions’ median incomes side-by-side, because the costs to achieve them may be dramatically different.

Most of the occupations on the highest-paying list require a medical degree. So factor in all that time, deferred income, schooling, and malpractice insurance for a more realistic picture of what’s involved.

Get a Complimentary Coaching Session to Achieve Your Goals Faster — Book Your Free Call Today >>

Taking Out Student Loans

I would never, ever borrow one cent for education. Student debt is not justifiable in today’s economy and has a high likelihood of destroying your life.

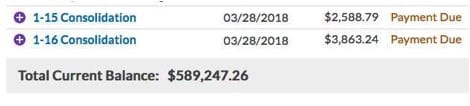

As you can probably tell by now, I don’t have the ability to make a $6,500-a-month student loan payment. That payment applies just to the two consolidation loans shown below, which are only about $390,000 of the total amount.

I walked away from the private loans years ago and do not consider them a legally valid or binding debt.

The statute of limitations has run out; the loan servicer fraudulently attempted to collect from a family member who was not a cosigner by telling her she would lose her home if she didn’t come through; and the servicer continues to illegally re-age the debt on my credit report every month. U

nfortunately, I’m too broke to hire an attorney to go after the servicer. I also know, as the saying goes, that “a lawyer who represents herself has a fool for a client.”

Get a Free Debt Relief Consultation — Visit Site >>

Because I never made enough money to manage the debt, it grew and grew and grew. I originally borrowed about $250,000 for undergraduate school, some grad school, law school, and business school. This is clearly a harsh lesson in compounded interest.

In theory, those federal consolidation loans will be forgiven after 25 years of payments, but the clock has hardly even begun to run because of in-school deferments, unemployment deferments, and forbearance periods. Consolidation can also start the clock all over; it’s sneaky like that.

Had I run up credit card debt or taken out a home mortgage to the tune of $600,000, it would be quickly erased by bankruptcy and I would get a fresh start in life. But due to the powerful lobbying of the student loan industry it is almost (but not entirely) impossible to discharge student debt.

Because of my student debt, I can't get a home mortgage loan; my credit is in shambles (so I’m paying 22 percent interest on a car loan); and I have serious problems being approved for security clearances. That alone takes a lot of jobs off the table for me.

Because I can’t buy a house, I’m locked out of building a nest egg, having stability, and living the American dream.

Borrowing for my education was the single biggest mistake of my life. Please learn from my mistake and never let yourself or anyone you care about go down that path.

It all seems so rosy in the beginning, so easy to convince yourself that once you finish school you’ll land an amazingly lucrative job and pay off those loans in 10 years or less. But unless every single thing goes right, this scenario can quickly spiral out of control. The repayment plans are only minimally helpful and actually serve to disincentivize you from making money.

It’s better to be as poor as possible and hope for a very low income-based repayment amount.

Get a Free Credit Repair Consultation — Visit Site >>

Giving Up a Job and Moving Across the Country for Love

Never give up a job and move across the country for the sake of love. Seriously.

Problem is, love sometimes takes over our rational mind and makes us do incredibly stupid, self-destructive things. We think we’ll find another job. I mean, there are so many out there. Besides, this guy is “the one” and cannot possibly be replaced. Right? Wrong! There are plenty more where he came from. That good job? Not so much.

I had a fancy federal government job in Washington, D.C. I could have stayed in that job forever, getting salary increases and gobs of benefits, never working more than 40 hours a week, never being stressed out.

Or if I had simply hung in there for three years, I’d have easily been able to move to a fancy law firm and make well into the six figures. Yes, I’d have worked 80-plus-hour weeks at a law-firm job.

However, I could have paid off all the student loans, built a nest egg, and started a whole second career doing something I actually enjoyed. But I was in love with a guy, and he wouldn’t move to where I was (ding, ding — red flag!). Leaving that job for a guy was the second-biggest mistake of my life.

I can't tell you how many incredibly smart, beautiful women I know who destroyed their careers for a guy — often one whose job was not nearly as good as the one they gave up.

We don’t get a do-over on those decisions, and we often underestimate the long-term financial setback.

I’m a romantic, so I hate to bash love. However, women need to start putting their own financial well-being first, ahead of anyone else’s, period.

If we can’t take care of ourselves, we’re going to be even worse off trying to take care of ourselves plus our kids, our elderly parents, or the guy who loses his job and decides it’s nice to have a sugar mama (somehow I’m a magnet for those).

Find a Better Way to Work — See How You Stack Up to the Competition >>

Having a Joint Checking Account With a Significant Other

Never put your income in a joint checking account. Create a private financial island for yourself.

It wasn’t until after Hubby Number 2 and I were married that I found out he had defaulted on his student loans. How did I find out? The IRS told me so when they seized my $3,000 tax refund. I should have filed for divorce on the spot.

Once the myriad creditors he'd flaked on figured out he was married to someone with a job, they all came a-knocking. I had already made the enormous mistake of adding him to my checking account before knowing how financially irresponsible he was.

He wanted to live the lifestyle of his wealthy brother, but my income couldn’t keep up. Over seven years of marriage, he bled me dry.

I should have left him much, much earlier. But again, love can make us lose perspective and fail to protect ourselves. I went from having a good job, starting a little retirement savings, and trying to be financially responsible to being destitute a decade later.

One of my exes claimed not to care about material things — unless it was his stuff, of course. He also liked to say he didn’t “believe” in currency. When he went on about how currency is this great evil, blah, blah, blah, I should have known right then that the relationship was going to cost me financially.

Not believing in our economic system didn’t stop his need for concert tickets, junk food, or a roof over his head. And guess who had to have the credit card and bank account to take care of those things? Yep, this girl.

I learned the hard way that I need to insulate my finances and avoid relationships with financially irresponsible guys. It makes sense to have a joint checking account for the household to cover the rent and/or mortgage, repairs, groceries, and utilities.

But both parties should be contributing to it from their own separate accounts. If a guy feels offended and accuses you of not trusting him, that’s a good sign not to trust him.

Get a Free Debt Relief Consultation — Visit Site >>

Jumping Into Marriage

Look long and hard before you leap when it comes to marriage.

I was going to make this section “Don’t Get Married Before 30,” but there isn’t any magic number or easy formula. I married too young at 23, but the next go-around at 32 was a much larger financial mistake.

The first guy was a hard worker, a saver, and a good person. It simply wasn’t the right fit at the right time. But my choices since then have all been highly financially irresponsible guys who caused me major financial setbacks.

I learned an important lesson about relationships from all of this. To make a marriage successful, a couple must be in sync on the Big Three issues: finances (responsibility and priorities), children (whether to have them and how to raise them), and sex (what kind and how often).

All sorts of other differences seem to work themselves out if the love is there. But those three go deeply to someone's heart and character. They were the exact reasons I had to walk away from the last guy, whom I loved deeply and thought I would marry.

Life Decisions That I Wish I Made

It may be easier to spot the big mistakes in life than to see what we passed up. This article is about things I would never do again, but it naturally made me think of what I wish I’d done.

The things I wouldn't put off could merit a lengthy discussion of their own, but at the top of the list? Travel as much as possible while young; save, save, save; and have kids when I’m in my prime and young and fit enough to keep up with them.

Some of the advice other women shared with me: Be more empathetic; always get a used car; max out your Roth contribution every single year; live as frugally as possible; go to a college either with in-state tuition or on scholarships and without any loans; and in general, do more of what you want to do and less of what others want or expect.