Evan Sachs

Think of a huge supermarket and the internet fused together to allow both professional and mom-and-pop investors all over the world to buy and sell shares (in other words, trade stocks) of publicly traded companies, big or small. The so-called “stock market” we hear about every day is in fact comprised of many stock markets. Nearly every nation has one.

At the heart of these stock markets are stock exchanges. These serve as the central marketplace where brokers (the middlemen) trade stocks and other financial products.

Why the Stock Market Matters

For the United States, the stock market is a key driver of the economy and key wealth builder for tens of millions of Americans, whether they’re middle class or stinking rich. When you buy shares of, say, Facebook or Microsoft, you become a shareholder. You get a little skin in the game.

Many investors enter the stock market by way of their retirement plans like 401(k)s and individual retirement accounts (IRAs).

For companies, the stock market allows them an efficient way to raise capital (money) so they can grow and prosper. The stock market is used to gauge and track the country’s general economic health. And the stock market has grown to become a reflection of our collective dreams, fears, and hopes.

What Is the Stock Market and How Does It Work?

When people think of the stock market, they envision a bunch of dudes in blue jackets running around like ants and yelling at each other on the trading floor of the New York Stock Exchange (NYSE), the world’s largest stock exchange. Some of that did happen once, but never again.

Today, most trades are handled by supercomputers housed in northern New Jersey.

Just imagine how the folks operating the Amsterdam Stock Exchange — the first of its kind — pulled it off in 1602 with their primitive technology.

But to understand the market’s workings, let’s first start with how a stock is born.

When a private company decides to “go public,” the first thing they’ll do is hold an initial public offering (IPO) in the primary market. It’s a closed-door event, open only to the big players like investment banks, asset managers, and hedge funds. Retail investors like you and I must sit and wait.

Once the new shares have been sold in the primary market, the stock is now available to the general investing public and ready to trade on the secondary market.

This is the stock market in which one investor buys shares from another investor at the prevailing market price or at whatever price both the buyer and the seller agree upon based on the NYSE and other major exchanges in Asia and Europe.

How Are Share Prices Determined?

It all depends on what a buyer will pay for it. High demand means higher prices and vice versa. To get technical, share prices are sorted out by a bid-and-ask system. The bid marks the highest amount a buyer is willing to pay. The ask notes the lowest price the seller is willing to accept. The difference is called the bid-ask spread.

Stock prices can fluctuate dramatically minute-to-minute, depending on the latest news and investors’ moods and whims. This is known as volatility.

Stock prices typically reflect future expectations based on current economic and geopolitical events, as well as company profits. That’s why when you try to buy a stock online through a discount broker, the price quoted won’t match the price you’ll eventually pay.

Plus No Fees! Get Started Today

What Are the Major U.S. Stock Exchanges?

All told, there are 12 financial exchanges in the U.S. that investors can use to buy stocks and other securities such as commodities and options. The NYSE and the Nasdaq (short for National Association of Securities Dealers Automated Quotation System) are the two biggest exchanges in the world.

There’s also a third U.S. exchange: the American Stock Exchange (AMEX). However, it specializes in listing exchange-traded funds, or ETFs, for purchase or sale.

Stocks that trade on the exchanges are assigned ticker symbols like APPL for Apple or NKE for Nike.

Overseas, the biggest European stock exchange is the Euronext, an all-electronic platform seated in several European cities. The biggest Asian exchange is the Japan Exchange Group.

The stock listings on the NYSE and Nasdaq and other exchanges are used to create indexes that track the performance of certain stock groupings.

In the U.S., the Dow Jones Industrial Average (DJIA or simply the Dow) is the granddaddy of indexes, tracking the 30 leading U.S. companies.

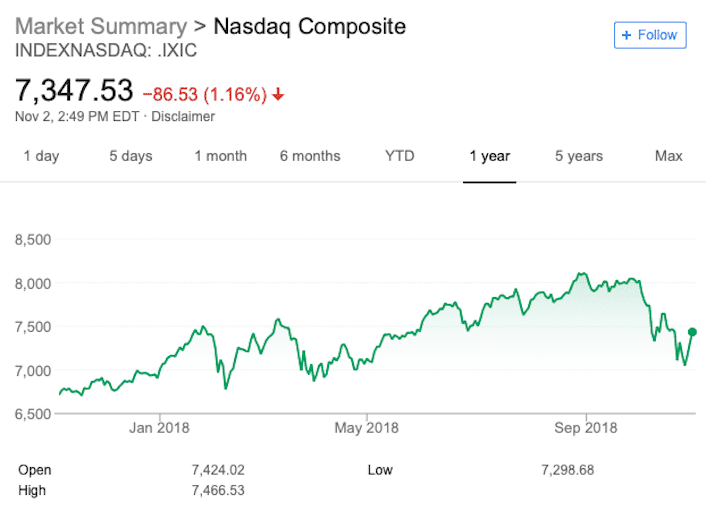

Then there’s the Standard & Poor’s 500 Index, which follows the ups and downs of the 500 biggest U.S. firms. Last is the NASDAQ Composite, which is an index of all 3,300 companies that trade on the exchange.

What’s the Difference Between the NYSE and Nasdaq?

Dating back to 1792, the NYSE lists stocks for over 2,800 companies worth a combined $22 trillion. Some of the oldest and most iconic stocks (blue chips) reside on the NYSE. These include Coca-Cola, Proctor & Gamble, and Kellogg’s.

The Nasdaq is a much younger competitor. It’s an all-electronic stock exchange that started in 1971. The exchange features more than 3,300 companies, and is best known for being a hub for high-tech firms and high-growth but risky companies.

Both Nasdaq and the NYSE open for trading at 9:30 a.m. and close at 4 p.m. Eastern Time.

After the major exchanges close, investors can trade premarket (4 a.m. to 9:30 a.m. ET) and aftermarket (4 p.m. to 8 p.m. ET). But chronic volatility and low trading volume makes trading outside regular hours a perilous bet.

The differences between NYSE and Nasdaq go beyond stock listings. Both exchanges have different transaction procedures and controls on the flow of trading orders. It’s also cheaper for companies to list on the Nasdaq.

Can You Trust the Stock Market?

Just remember that the NYSE and the Nasdaq are controlled by profit-making, publicly traded corporations whose core mission is to first serve their shareholders, not the investors who come to their exchanges to buy and sell.

Also remember that the stock market can easily turn from being everyone’s darling to a wealth-destroying monster. Moreover, many investors still haven’t recovered from the stock market collapse of 2008–2009.

The Securities and Exchange Commission (SEC) regulates the stock exchanges and the Financial Industry Regulatory Authority (FINRA) oversees the stockbrokers who trade on the exchanges. But their oversight authority is limited. Stock prices can be manipulated by sophisticated traders and investors who know the system inside out.

That said, despite its imperfections and vulnerabilities, the stock market succeeds and rewards investors a lot more than it fails them. Investors should take that to heart.