If you’re a freelancer, you’re well aware of just how crucial it is to stay on top of your housekeeping for taxes. And a major part of handling your taxes when you’re self-employed is trying to figure out if an expense is tax-deductible.

Can you write off that bagel you had while working at the coffee shop? How about the bike you rented while traveling for a business conference?

To make such of the muck, we’ve asked Eric J. Nisall, who runs AccountLancer, to give you the lowdown on tax deductions for the self-employed.

Freelancer? This Online Accountant Is Designed to Support You >>

1. Website-Related Expenses

This includes any domains, hosting, themes, and plugins you’ve purchased with your business’s websites.

2. Marketing

2. Marketing

Any costs related to marketing your business and services can be deducted. You can also deduct expenses for your professional website. (We said professional – so that photo session for your dating profile doesn’t count.) Did you pay for a logo through 99Designs? Be sure to deduct it!

3. Travel

Whether you traveled by plane, train, or automobile for work, you can deduct those for taxes. You can also write off accommodations – such as a stay at a hotel or AirBnB – and bike and car rentals during business trips.

Save on Your Travel Expenses — Get Prices From a Leading Provider >>

4. Meals and Entertainment

Did you take a client out to lunch? If so, you can deduct 50 percent of the cost of entertaining clients or treating coworkers or employees. Note that this does not include stuff you bought for yourself at the grocery store or the daily java fix you get while working at the local coffee shop.

5. Dues and Memberships

Any dues and memberships you pay to be part of a professional networking group can be written off. Plus, if you pay for subscriptions to newsletters and magazines that are related to your career (think Fast Co. and Inc.) can be deducted.

Save on Your Bills and Manage Unwanted Subscriptions — Sign Up Here >>

6. Equipment

This includes anything from laptops and tablets to scanners and cameras used to run your freelance business. You can also write off furniture you bought for your home office, too.

7. Online Tools

Software or online services you purchased to run your business can be deducted. Expenses that fall under this category include tools for photo editing, project management, social media management, stock photos, email service, invoicing, and accounting. Even your tax prep software can be deducted.

Get the Most out of Your Refund — File Business Taxes Today >>

8. Bank Fees

Those pesky monthly fees, ATM fees, and overdraft fees are actually tax-deductible. Note that fees from a business account are 100 percent deductible, but if you have just one account for both personal and business expenses, you’ll only be able to write off 50 percent of your fees.

9. Merchant Fees

Yes, those pesky PayPal fees on the payments that you received from clients are tax-deductible. If you operated an online store, you can also deduct any merchant processing fees relating to your business.

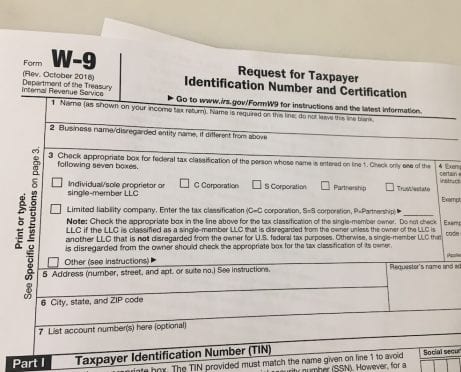

10. Contractors

If you hired any freelancers to help you with your business, you can completely deduct those expenses for taxes. This includes writers, editors, photographers, designers, researchers, social media managers, and virtual assistants – even if you hired them through Fiverr.

Find the Perfect Freelance Services for Your Business — Visit Site >>

11. Professional Fees

Fees you paid for professional coaches, lawyers, accountants, and financial planners to help you with your business are deductible.

12. Education and Training

If you enrolled in an eCourse or workshop, you can deduct those for taxes. This includes anything from eCourses, seminars, webinars, and related books you purchased to boost your freelance career.

Achieve Your Career Goals With Industry-Recognized Learning Paths — Choose Your Course >>

13. Conferences

Any tickets you purchased for a professional conference can be deducted. You can also deduct expenses related to the conference, including travel and food.

14. Mileage

You can deduct any miles that you log on your car to meet with a client, travel to and from your office or coworking space, or pick up office equipment or supplies. Everlance is a great app to help you track mileage.

15. Physical Office

If you rent a physical space that’s entirely separate from your home office – whether it’s your own office or a coworking space – you can deduct it for taxes.

You can still get a deduction if you have a home office, but the space has to be solely dedicated to your work. If it turns out that you do have a home office, you can deduct part of your rent and utilities, mortgage or renter’s insurance, and maintenance. Not sure if the space in your digs can be considered a home office? You can take this test to figure it out.

16. Supplies

Those old-school office supplies – all the journals, pens, stamps, and paper shredders? Totally deductible. You can also deduct supplies related to your business, such as packaging tape if you sell wares on Etsy.

17. Insurance

If you signed up for health insurance through the health insurance marketplace, the good news is that you can deduct your monthly premiums. You can also deduct premiums on your dental and long-term care insurance, liability and professional insurance, and car insurance if you use your car for work. You can check out a complete list of the types of insurance you can deduct for taxes here.

The Bottom Line on Tax Deductions for Freelancers

Exactly how much can you deduct for each type of expense? Well, it really depends on the extent to which they’re related to your business, Nisall explains. For instance, if you have a car that you use solely for business expenses, that’s 100 percent deductible. On the other hand, if you use a cell phone for all of your calls, then that’s only partially deductible.

So there you have it. The low-down on tax deductions for freelancers. If you have questions on your specific situation, be sure to reach out to a certified public accountant (CPA). They’ll make sure that all your bases are covered. Here’s to doing your taxes with relatively low stress and confusion!

Get the Most out of Your Refund — File Business Taxes Today >>