The Tax Cuts and Job Act of 2017 is hotly contested for its drastic tax breaks for corporations and the top one percent of households. But it does offer small businesses a significant breather — at least until 2025. Here are a few things to ask your accountant as tax season approaches:

1. As a small-business owner, what is the most important tax cut I should know about in the new tax law?

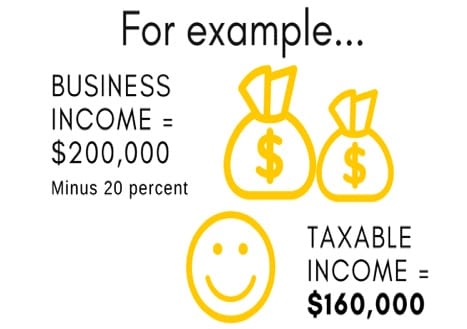

The largest cut is a 20-percent deduction for pass-through income. This refers to business income that is reported as personal income by the small-business owner, rather than being taxed through a corporate tax structure.

If you're a sole proprietor or an independent contractor providing labor services — such as a self-employed IT specialist, a pizza-shop owner, or a real estate investor — you are most likely eligible for this tax break, which means that you shave 20 percent off your earnings before paying taxes on the rest.

If you're a sole proprietor or an independent contractor providing labor services — such as a self-employed IT specialist, a pizza-shop owner, or a real estate investor — you are most likely eligible for this tax break, which means that you shave 20 percent off your earnings before paying taxes on the rest.

Get a Free Tax Relief Consultation — Visit Site >>

But there are limits on who can claim the pass-through deduction. If you're an individual earning more than $157,500 or from a household that earns less than $315,000, the deduction is capped at either 50 percent of wages or 25 percent of wages, plus 2.5 percent of capital assets — whichever is greater.

2. How do I know if my business’s earnings qualify as pass-through income?

If your business is a partnership, an S corporation, or a limited liability company, you generally qualify for this deduction. Pass-through income simply means that company revenue passes to the owner, who is taxed at the appropriate individual tax rate. If you're a company founder or partner, this perk should apply to you. Also note that categorizing your income as pass-through income allows you to pay a generally lower tax rate (29.6 percent) than on personal income tax, depending on your income bracket.

3. Should I consider incorporating to benefit from further tax breaks?

Some pass-through businesses might decide to become corporations to reduce their tax burden.

In a bid to increase global competitiveness, the new tax law slashes corporate taxes from 35 percent (one of the highest rates in the world) to 21 percent.

But unlike the other provisions for personal income taxes and pass-through income, which phase out on December 31, 2025, this provision is permanent.

Save on Your Bills and Manage Unwanted Subscriptions — Sign Up Here >>

That said, before you incorporate, consider issues like financial liability and changes to accounting methods. As a corporation, you’ll be required to use accrual accounting methods. With this process, expenses are recorded at the time they are incurred, rather than when they're paid. This can complicate the process of tracking real cash flow because there is often a delay between when a business processes an order and when it receives payment. Unincorporated small businesses, on the other hand, tend to rely on cash accounting. With this method, outlays and earnings are recorded and taxed in the period they are collected or paid.

4. Are there any other tax breaks I should consider in the new tax law?

Yes — but only if you qualify. Does your small business export goods or services? Or does it conduct significant research and development to actively develop new products or processes? If you run a pharmaceutical company or are an education entrepreneur or a tech disruptor with the potential to become the next Uber, this could be your godsend. The new R&D tax credit, introduced in 2017, allows you to claim up to $250,000 per fiscal year.

First things first: You should work with an accountant to conduct an audit of your business’s R&D expenses. Your accountant will then file Form 6765, Credit for Increasing Research Activities, with your business’s annual income taxes. If eligible, you can expect a hefty credit. You can use this to reduce taxes on taxable income or payroll depending on your company’s profit or loss situation.

5. I conduct business overseas as well as domestically. How can I max out my tax breaks?

If you export goods or services or produce a widget that is included in a larger item that is exported (such as a component part for an electronic device sold overseas), know that foreign profits will be taxed at a lower rate. While this might galvanize multinationals to offshore their operations and headquarters, it’s an incentive to small businesses to expand internationally. Small and medium-size enterprises, or SMEs, accounted for 98 percent of U.S. exporters in 2013 and continue to be a linchpin of economic growth.

If you want a comprehensive list of revisions in the new tax law, Bloomberg has an excellent article.

![[VIDEO] Tax Loss Harvesting in 2 Minutes or Less](https://centsai.com/wp-content/uploads/2017/12/iStock-516427450-461x372.jpg)