Last week, I participated in a Cooperative Extension Twitter chat for America Saves Week (ASW). The theme of the Twitter chat and its accompanying video chat was planned saving. “Save with a Plan” was the theme for Day 2 of ASW 2020. Below are some ideas that I shared and heard from others about the benefits of planned saving and how to do it:

- Develop a savings plan for emergencies and short-term, medium-term, and long-term goals. Identify an amount and a time deadline with this worksheet.

- Do research on the total cost of your savings goal (e.g., a vacation trip or a new car). Then do some math. Divide the cost of the savings goal by the number of months to save to get the monthly savings amount.

- Look for online resources to help you save with a plan such as these financial calculators from Bankrate.

- A savings plan makes you more future-minded; it forces you to think about what you want and when. A plan also helps you see your progress. If you save $2,500 toward a $5,000 goal, you are halfway there.

- Re-evaluate your savings plan at periodic intervals like every 6-12 months. You need some time to see progress. Also re-evaluate your plan when life circumstances change (e.g., a big raise or marriage).

- Automate your savings if you have a regular paycheck. Otherwise, save when you can (e.g., when you get a bonus or income tax refund) if your income is volatile.

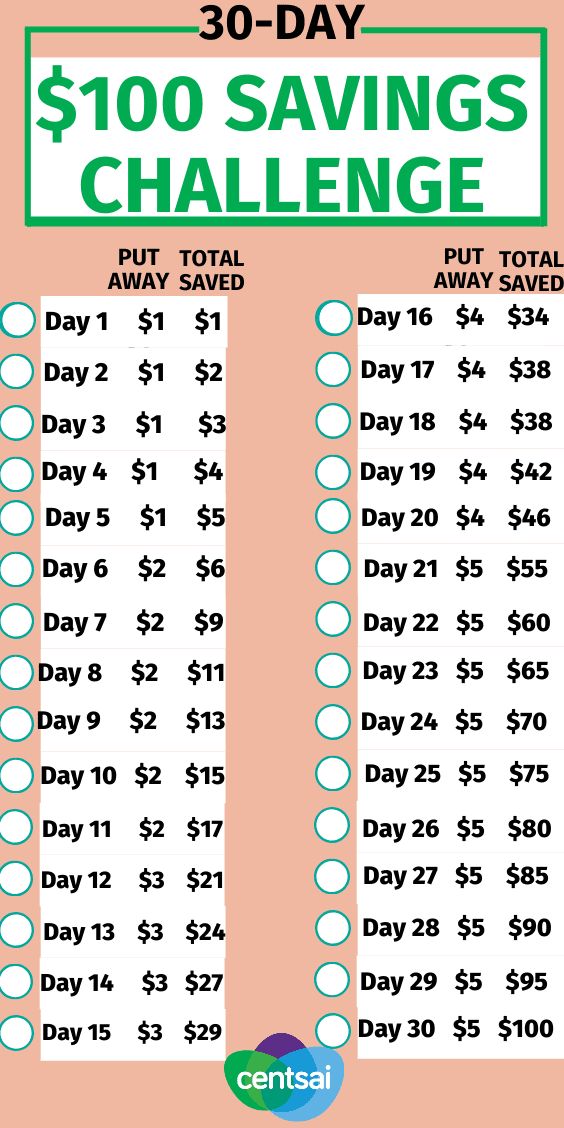

Start small with the 30-Day $100 Savings Challenge starting on March 1, 2020. It is a strategy for planned savings. On March 30, you could have $100 saved by saving daily amounts ranging from $1 to $5.