Art by Jonan Everett

Whether you’re 17 or 67, if you’re paying for college, getting a federal student loan or three is probably high on your to-do list. Federally guaranteed loans are relatively inexpensive. Most college students in the United States use them to bridge the gap between their savings and the cost of college.

Before you actually sign on the digital dotted line, though, you have to participate in mandatory student loan entrance counseling at StudentLoans.gov. Nice!

When I was getting ready to go to college back in the ’90s, I read — or more accurately, didn’t read — a lot of paper about the loans I was taking out. But today, I dusted off my Federal Student Aid login and walked through some cool online simulations to find out what the feds are telling today’s students about the loans they’re signing up for.

Cut Down the Cost of College — Easily Apply to Scholarships Today >>

Federal Student Loan Entrance Counseling Is for Direct Loans Only

The first thing you need to know about federal student loan entrance counseling is that it’s only for certain kinds of borrowers: undergraduates and graduate students taking out direct subsidized or direct unsubsidized loans, or graduate students taking out direct PLUS loans.

A direct loan is one that’s made directly by the federal government — specifically, the U.S. Department of Education. The loan's servicer (the company you actually write your checks to) may be a different company, but you owe the feds, not your school or a private bank.

These loans have lower rates than private loans do. Direct subsidized loans are an especially good deal for undergraduates. If you demonstrate financial need, the government will pay the interest while you’re in school and for six months afterward. With direct unsubsidized loans, you pay the interest the whole time.

Federal Student Loan Entrance Counseling Walks You Through Your Finances

Federal student loan entrance counseling takes about a half hour and helps you work with your real numbers as much as possible. Ideally, you’ll have done some math first and figured out approximately how much you’ll need to borrow. I

f you don’t know how much you’ll borrow, but just want to try the system out, you can add a hypothetical loan based on the average debt of U.S. college students.

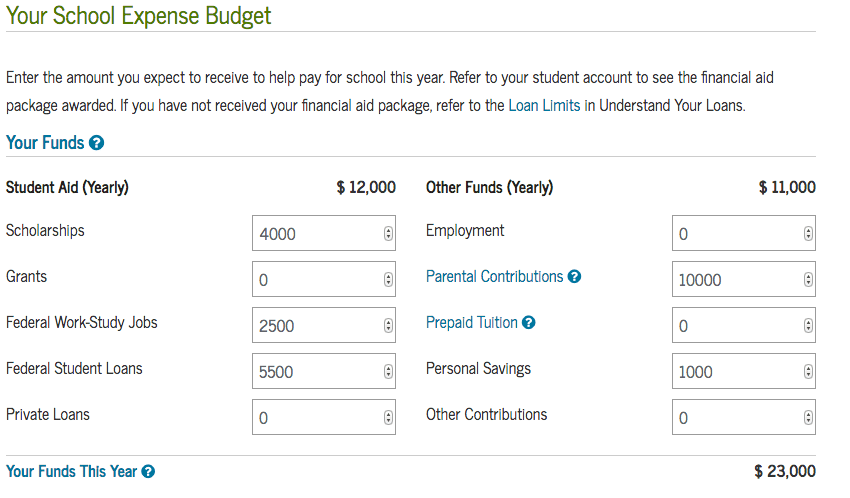

Later on in your counseling, you enter the sources of all your funds for school, along with your expected expenses. Then you enter your expected salary.

Calculator widgets take all this data and project information specific to your situation. How much would you save on interest if you paid interest on unsubsidized loans while in school? How much will your monthly payment be using different kinds of student loan repayment plans? What would it cost to defer your loans for six months or a year?

The entrance-counseling process also gives lots of information specific to different kinds of borrowers. College freshmen, for example, are limited to borrowing $5,500, while college juniors are limited to $7,500.

Students who aren’t dependent on their parents have higher limits. No matter what your situation is, you can find out what direct federal loans are available to you during counseling.

The Perfect Scholarship Could Be Waiting For You. Find Out More Here >>

It Tries to Help You, Not Sell You

Unlike private lenders, the federal government has your best interests in mind. It doesn’t have to make a profit on loans, so it’s not trying to up-sell you on more expensive products.

In fact, federal loan entrance counseling also teaches you how not to borrow.

The first page has a section on ways to look for “free money” — that is, grants and scholarships — before you start to borrow.

Plus, federal student loan entrance counseling instructs you on how to look for subsidized and low-interest loans before doing more expensive borrowing. It’s packed with suggestions for reducing your annual expenses and improving your annual income so you can also reduce the amount you need to borrow.

Finally, entrance counseling clearly teaches you how to avoid extra interest and fees by paying on time (or working with your lender if you can’t), paying interest while you’re still in school, and seeking out loan forgiveness plans if eligible.

It's Incredibly Educational

I know an awful lot about student loans, and I’m impressed by the amount of information packed into this 30-minute experience. If you complete the whole program, you will learn . . .

- technical terms you need to understand the loans you’re taking out

- how to budget

- how to reduce expenses

- how to find sources of money for college

- how to become and remain eligible for federal loans

- how to project and, more important, reduce your final payoff amount

- how to avoid defaulting on your loans, even if you run into financial trouble

- under what circumstances your loans can be forgiven or discharged

- how to keep records related to your loans

- and more!

The last part of the counseling, called “Finances, a Priority,” even gives you a quick tutorial on credit, taxes, identity theft, responsible credit card use, and other subjects that I definitely wasn't thinking about when I went to college.

In order to exit the program you need to answer questions to prove that you learned something, too. That’s good practice for college!

Choose From Fixed or Variable Rates on Your Student Loan — Compare and Save >>

Final Thoughts

Federal student loan entrance counseling may not sound like something you want to spend a half hour on when you could be at the beach. But it’s mandatory if you want to borrow from the federal government. It will also give you specific, actionable information about your finances. And it’s even pretty fun. Highly recommended!

This is the first installment in a four-part series on financial aid. It will publish each Friday through August 3, 2018. The next piece is “How Does the TEACH Grant Work? Watch Out for Requirements!“