1. Why would I want to refinance my home?

You may want to refinance if you purchased  your home and want to stay, but you are looking to lower your interest rate; to change the type of loan you have (i.e. take advantage of low-interest rates to lock in a fixed-rate mortgage, or get an adjustable rate that may give you some more breathing room); or if you need to borrow some cash from the equity in your home.

your home and want to stay, but you are looking to lower your interest rate; to change the type of loan you have (i.e. take advantage of low-interest rates to lock in a fixed-rate mortgage, or get an adjustable rate that may give you some more breathing room); or if you need to borrow some cash from the equity in your home.

Refinancing can help you accomplish these goals.

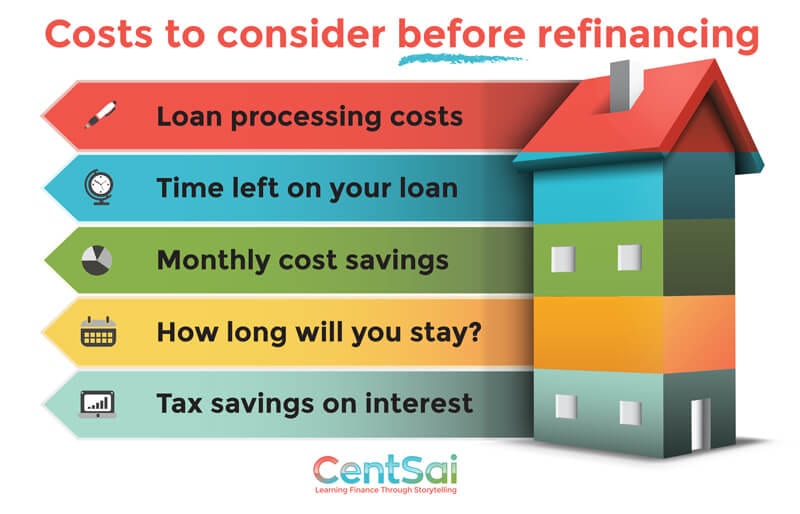

However, there are significant costs involved in home refinancing, so in order to weigh your options, you need to carefully consider the true cost to you.

2. Do I qualify for home refinancing?

A refinance is actually a new loan. You’ll be paying off your current mortgage and obligating yourself to a new loan with new terms. Lenders will want to know that you qualify for the loan, so your income, assets and liabilities, employment, and credit history will be important – just as it is for any new loan.

3. What will the lender ask me to provide in order to refinance?

You will be asked for proof of income and assets. This could include bank statements, tax returns, W-2 statements, and recent pay stubs or 1099 statements.

You may be asked to prove that you have the funds for your down payment and closing costs. If you’re borrowing those funds, make sure to be upfront with your lender in order to avoid disappointment later. The timing of the deposit of funds into your account – and the source of those funds – are important details for the lender. For example, whether the funds represent a cash advance on a credit card, a loan, or gift will affect your loan approval in different ways.

You may be asked to prove that you have the funds for your down payment and closing costs. If you’re borrowing those funds, make sure to be upfront with your lender in order to avoid disappointment later. The timing of the deposit of funds into your account – and the source of those funds – are important details for the lender. For example, whether the funds represent a cash advance on a credit card, a loan, or gift will affect your loan approval in different ways.

4. Will home refinancing lower my monthly payment?

It can. If you can get a lower interest rate than you currently have, you may be able to bring down your monthly payment. For example, if you have a $200,000 loan balance and your current interest rate is 4.5 percent on a 30-year loan, your interest and principal payment is approximately $1,013.

However, if you can refinance to a 3.5 percent interest rate, your payments will be reduced by about $115 to approximately $898 per month. But that isn’t the end of your calculations to determine if home refinancing is a wise move for you…

5. What will it cost me to refinance?

There is a cost to home refinancing. The cost can be charged at closing, or it may be rolled into the loan. To calculate your savings, subtract your new principal and interest payment from your current one.

Take the costs of making the loan and divide it by your savings. This is how many months it will take to break even on your costs.

There are other financial considerations to take into account, as well, such as the additional time left on your loan. For example, you may have had 30 months left, and now you have 360 months to pay off your mortgage. Estimate how long you plan to stay in the home, and calculate the savings over that time frame. Generally, if you don’t plan on staying for more than two years, you’ll probably spend more than you save.

Another consideration is the difference in your tax savings. The earlier into the mortgage you are, more you pay in interest and the less in principal. This will make a difference in 4. Will home refinancing lower my monthly payment?your loan balance when you sell. It will also make a difference in your tax savings, since the interest on a home loan is tax-deductible.

Don’t forget that if your home is on the market, most lenders won’t allow you to refinance.

BONUS! I want to pay off my mortgage faster. What are my options?

Most 15-year loans have a lower interest rate than 30-year loans. You can refinance from a 30-year to a 15-year term to pay off your loan faster. However, instead of incurring the costs and starting over on a new loan, you can also make additional payments to your existing loan. To see which option is better for you, calculate the cost of home refinancing and compare that to the potential savings.