According to recent reports by Wells Fargo and Merrill Edge, millennials, who form 25 percent of the US population (and one third of the global total), do save but shy away from investing in the stock market.

Saving is a great first step for taking care of your financial future. But it is not enough. If you are in your early 20s you probably feel that “there is no rush”. But if you understand and appreciate the implications of inflation and the compounding principal, you might start thinking differently.

Millennials’ fear of and lack of trust in financial markets is understandable!

One of the main reasons behind this attitude is a lack of knowledge of financial markets and investing. I completely support this argument. Knowledge is Key! You must gain knowledge and understanding before you make any investment decision. If you’re wondering now whether the ‘education’ is worth your while, I would say: most definitely!

Learn How to Invest Confidently — Download This Free App >>

Here is why.

Let’s first tackle the inflation issue:

Example 1:

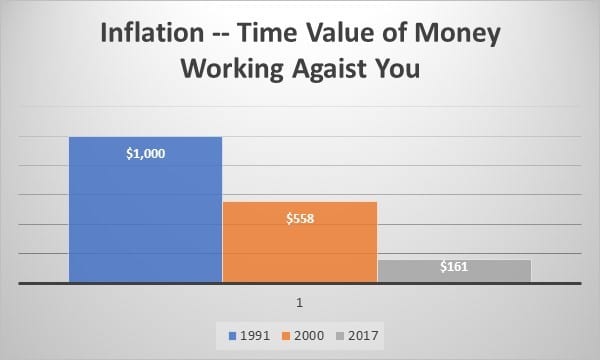

The total rate of inflation from 2000 to 2017 (i.e., 18 years) has been 44.2 percent.

To put this in context: if you could buy TWO iPhones in 2000 for $1,000. This $1,000 in 2017 has a purchasing power equivalent to only $558 and suffice for only ONE iPhone (maybe not the very latest one).

Example 2:

The total rate of inflation from 1991 to 2017 (i.e., 27 years) has been 83.9 percent.

We increased the time by half of the time (i.e., by 9 years) but the effect of inflation almost doubled!

Now the $1,000 you had in 1991 will not buy you even ONE iPhone in 2017, as it’s purchasing power diminishes to $161.

Therefore, if you simply put your money aside in a “piggy bank” hoping to use it in the future, this may turn out to be futile.

As it might lose its purchasing power in its entirety. The chart below vividly demonstrates this point:

You may say…but I am putting my money in a savings account. Unfortunately, a savings account will not give you more than 1-1.5 percent interest annually. If the rate of inflation is 2 percent and above annually and forecasted to be, on average, 2.2 percent annually in the next 5-10 years, then you are always going to “lose” money if you put it in a savings account.

Some may offer a percentage or two higher than the 1-1.5 percent but they would also ask you to lock the money for a few years and “park’ a significant amount of money for that time.

Build Your Personalized Portfolio in Minutes — Start Investing >>

So How Can You Combat Inflation?

Now suppose that instead of putting your $1,000 in a “piggy bank” you went ahead and invested it in the market. If you have no finance knowledge you may elect to invest in the Index. The S&P 500 in the past 90 years have had, on average, 9.8 percent annual rate of return.

Of course, there were years that it experienced a bear market with negative returns, such as during the dot.com bubble burst in 2001 or the financial crisis in 2008. Long term, however, markets tend to have an uptrend with positive returns.

Let’s be conservative and assume an average 6 percent annual rate of return, and see what happens:

A $1,000 invested in 2000 at the compounded annual return would be $2,854 in 2017.

A $1,000 invested in 1991 would grow to $4,822 in 2017.

With this approach not only have you combated inflation, but you may be able to buy much more than the two iPhones you originally could when you just started investing.

This example also shows that the sooner you start investing the better. Let’s explain this important point a bit differently.

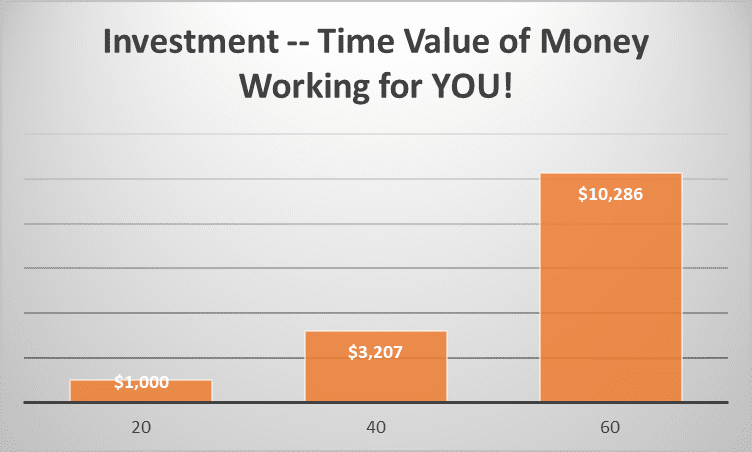

Suppose that you are in your 20s and believe that there is no rush to start investing and postpone this until you reach 40. Let’s further assume that you would like to retire when you are 6o years old.

$1,000 invested for 20 years at a 6 percent annual rate of return will amount to: $3,207.

But, if you were wise to start investing in your 20s then:

$1,000 invested for 40 years at 6 percent annual rate of return will amount to: $10,286.

This is to show you that if you have stared 20 years earlier you could have more than TRIPLED your investment. (not doubled, but tripled!) Therefore, it does not make any sense to wait. Every penny you invest today can make a big difference on your financial future and freedom.

Saving is a first great step of thinking of your financial future and being active about it.

If you only save and do not invest, however, you may experience a “Double Whammy” – one from the erosion on the value of money due to inflation and the other from “missing out” on the return you could have gained with investing.

Build and Personalize Your Investing Portfolio — Get Your Stock Advisor Offer >>

Don’t make this mistake. Be wise with your money.

More on how to invest (wisely!) will be addressed in future articles.

If you have any questions, comments, clarification, please feel free to contact me at mr649@nyu.edu or @HoliSym

![[VIDEO] What Is Blockchain?](https://centsai.com/wp-content/uploads/2022/11/blockchain-RESIZED-461x372.jpg)